Introduction

This research examines some of the factors revolving around the housing markets in the UK. The industry has been marred by unpredictable variations over time based on various macroeconomics. This is not a unique situation not only in the UK but also in the rest of the world. This analysis is therefore valid since the factors play an instrumental role in stabilizing or crushing the housing markets. This research, therefore, observes factors such as the GDP income, taxation, interest rates, and rates of employment, loans, demographics, and inflation among other macroeconomic factors and their influence the housing industry in the UK.

The residential property markets have witnessed cyclical variations both in number and prices across the globe as evident in the trends from the past decades. These variations have been experienced in most of the industrialized nations in the world. There has been a surge in the volumes of the housing properties and relative fluctuations in the pricing of the properties depending on the dynamics in the economies and markets (Cook and Watson 2016, p. 2). The cycles in the real estate industry are often characterized by a by a price surge and a subsequent fall or crash. These variations have been commonplace in the UK housing markets in the past decade to date. When the UK witnessed financial liberation in the past, there was a massive boom in the property sector. The situation was, however, coupled with an upshot in the interest rates which thus prompted a decline in pricing of the residential houses. For an incisive understanding of the research it valid to dissect the meaning of the housing markets

What is housing markets?

There is a misleading assumption that housing market is a single entity, houses. There are two distinct issues about the markets that are essential to understanding; the tenants and the owners. The tenants consume the services by finding a place to live in a while to the owners is a business investment. It is, however, beneficial to the owners in that they enjoy the owner-occupier privileges and so they do not have to pay rent and also to earn from the investment. The housing markets are thus governed by two prices; the rental prices which are integral in balancing the supply and demand for receiving the housing services, and the house prices which importantly balance the supply and demand for the housing when perceived as an investment (Gray 2015, 6). It is likely that all the players participate in the industry differently with one as a tenant while the other as the owner, buyer or seller. The two markets have a massive correlation because despite being separate their intersection largely determines the rental prices and the rates of home ownership. Rents play a central role in determining the prices of houses because it tends to show how lucrative it is to own in contrast to the actual renting. The prices of the houses, however, do not influence the rents.

Whereas rents can influence the prices of the houses, it is not the only factor contributing to the fluctuations in the housing markets. There is a range of factors at play that contributes to the annual costs experienced by owners. Factors like the mortgage interest rates have a key role impacting on the infamous user cost capital. The mortgage rises, the cost of owning s property is also linearly affected. When the income that would have been earned on equity and was supposed to be invested in a different asset is tied up in the housing markets is affected (Nuuter et al. 2015, p.78). Some other factors influencing the housing markets are the maintenance costs, taxes on the property, annual GDP and inflation determine the variations of prices in the housing markets.

The current state of the housing markets in the UK

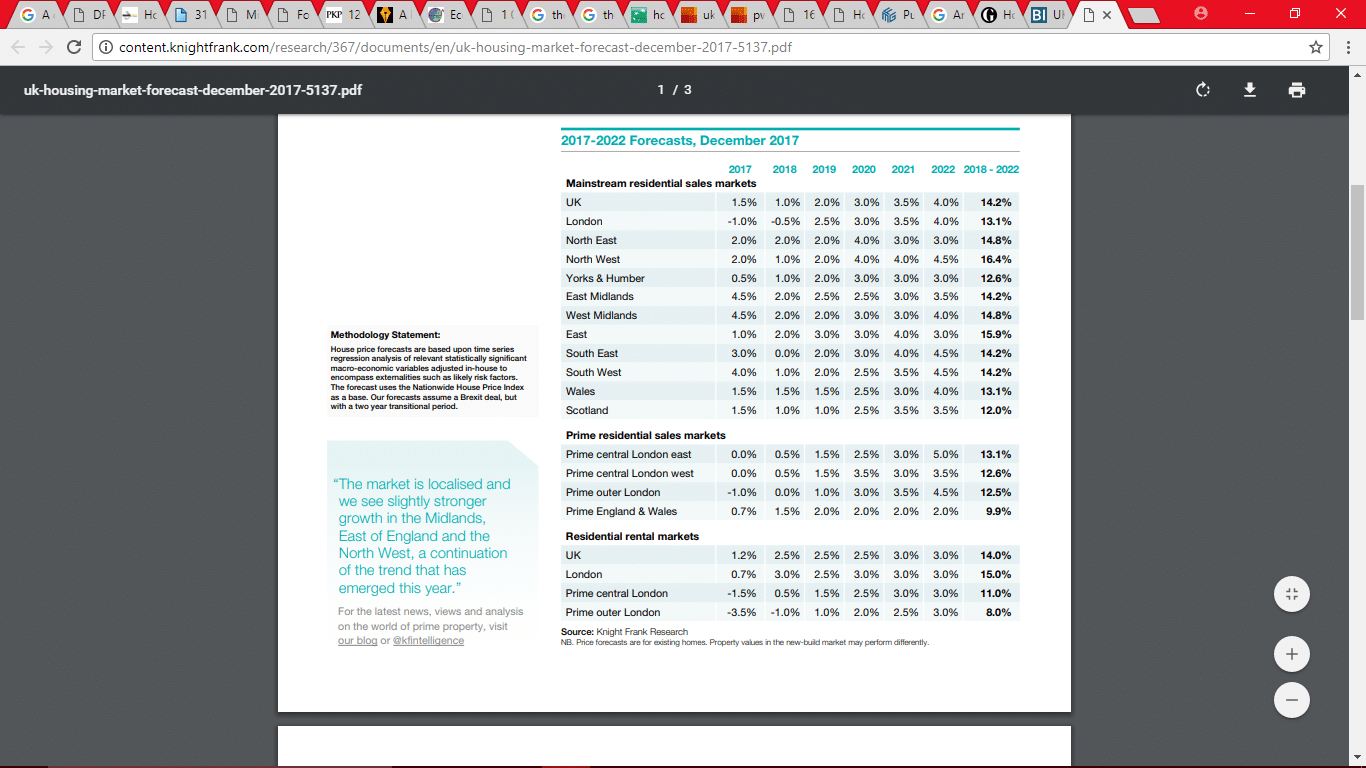

From 2014, the housing markets have downscaled in growth whereas the annual changes have been positive. The growth in the industry is projected to stand at 1.0% in 2018 and cumulatively at 14.2% in the next five years from 2018 -2022 (Gray 2017, p.5). The UK has experienced a moderation in house prices based on a range of factors some are pegged on the Brexit. This is very different from the growth in property the country has registered in the past decade. In the past five years, the UK registered a growth rate of 28.0% in the property sector but has since come down as can be seen in the cumulative forecast in the five running years from 2018.

The table below shows the housing markets forecast for the years 2017 – 2022.

The table shows minimal growth in the housing markets in the UK as projected for the next five years (Knight 2017, n.d). The meager growth in the property sector is hinged on series of factors. These include the move by the UK to break away from other European trade partner during Brexit, the constraints on mortgage and hikes in the interest rates listed here.

Factors influencing the slow growth in the housing markets in the UK today

Brexit. Since the trade alliance is an unfavorable deal for the UK, Breaking caused some economic ripples that have had a detrimental impact on the housing impacts. London being a global financial center, the economic implications of the move must fall back on the local economy. The UK government also experiences prolonged economic upheavals that have facilitated instability in the country (Business Insider, n.d). The general elections have undermined the local economy, and the consumer confidence has downscaled leading to the fall in the housing markets. The financial systems have implemented a hike in the interest rates which have impacted harshly of the property markets. The economy of the country has not performed as anticipated and the ripples are entrenched in the property portfolio. The UK economy has also been affected by the increasing geopolitical tensions which have slowed down the global economy. Changes in the property taxes have a negative influence in real estate investment (Tsai 2015, p.14). The changes have been backed by policies that encourage more taxes on the purchase, and the additional charges have crippled the activity in the housing markets.

Related Literature

Related studies on the subject have established that the variables are influencing fluctuations in the housing markets the GDP, interest rates, inflation, income and the rate of unemployment (Strohsal et al. 2015, p.1). These play a key role in either shaking or boosting the industry. The literature about the influence of the macroeconomic influence on the housing markets is wide. Before the subprime crisis on the mortgage markets in the late 2000s, the then researchers for many years used linear regression models to evaluate the relationship between the dynamism in prices of houses and the macroeconomics. In the research papers, there is an application of regression in the evaluation of how the growth of the property prices is geared by economic factors such as inflation, interest rates, economic growth, and unemployment among other factors. According to Li and Chau, interest rates are identified to have massive influence in the industry than the rest of the variables. Based on a pooled cross-sectional data from the research, variables such as employment, interest rates were still proved to have an immense impact on the prices of houses.

It has been observed that with advancement with time, the property prices have remained sensitive to with the variations in interest rates due to the financial liberation of the independent countries in the UK like England, Scotland, Wales and the Northern Ireland at the individual state level. These sentiments have been shared by many researchers who also confirm that the variables play an instrumental role in influencing the property prices. Thy affirms that the housing prices get more sensitive in instances of long interest rates especially when the rates were lower in the recent past. In the cities where property values grow faster in the UK, the prices are more sensitive to the implementation of long term interest rates (Hinch et al. 2015, p.4). The scholars have different the effects of both short and long term interest rates in which they have elucidated that short term interest rates hurt the demand for housing since it is influenced by the mortgage rates. This is also coupled with the cost of financing by the property companies.

Evaluation of the individual macroeconomics and how they influence the industry

GDP income

There is an immense relationship between the housing market, GDP, and income. A decline in the housing markets has a negative impact on consumption and GDP. The same is true if when the economy is unstable and the growth index is slow so that that the growth index in the property industry is slow. Significant growth in the GDP has an appositive impact on the housing market (Stockhammer 2015, 6). Based on the data of 17 industrialized nations when exposed to variance decomposition, the GDP has a long term variable contribution on the pricing of housing. This contribution, however, cannot exceed 10% of the total variation in the markets. The short-term relationship between the GDP and the housing markets is stronger in contrast to the long term. As can be retracted from the argument, the UK GDP also has a bidirectional influence on housing markets depending on whether the projections are long term or short term. A five-year projection from 2017 – 2022 indicates that the UK will record a growth index of 14.2% and 1.0% in 2018.

Taxation

The government does impose taxes in the housing markets for two main reasons. This is because of the high market value of the portfolio regarding stock and, the reliability of the industry since it is immobile and durable, the latter makes the industry inalienable from tax. The taxation, however, is favorable to developers and owners to encourage more investments in the industry and provide affordable housing to the citizens (Strohsal et al. 2015, p. 28). The taxation policy is therefore designed to provide tax cuts to investors in the housing markets through tax deducts as popular with most industrialized countries and widely entrenched in the UK housing policies. Researchers have gathered that imputed taxation of rents and related residential taxes result into a distorted housing markets. Arguments have risen that whenever there is a preferential tax treatment the social welfare is lost, there is thus a monumental shift to investment in other sectors thus leading to crowding of the sectors. There is a possibility of housing stock rising thus an escalation in the price levels. There have been changes in property taxes in the UK in the recent past as implemented by policymakers (Healy 2017, p.3). These have caused fluctuations in the housing markets and have led to high pricing of the properties. Therefore, most people have shied away from acquiring properties in the UK leading to the low growth index today.

Loans

These are credits provided by banks in the facilitation of mortgage. In 2008 the loans provided by the UK financial systems ranged from 40 – 50% of the country’s GDP (White et al. 2015, p.18). They favored housing markets industry coupled with the financial liberation at the time the saw the housing markets grow. According to research based on mortgage loans, when there is a decrease in the prices of the houses, the banks also tend to reduce the capital. They, therefore, limit the possibility of lending towards mortgages. The banks, in this case, are confining investments in the housing markets. Arguments have thus come up that when prices in housing markets escalate, the banks provide more lending towards the investments so that the ratio of the loan to the collateral value is considerably higher. That implies that the ratio of loan is higher than the value. Banks have in the past provided fair loans to potential investors in the housing markets in the UK. This led swelling volume of properties in the country. This was encouraged by stability in the markets (Meng et al. 2017, p.42). The dynamics in the market came to play that brought the growth level low. The loan to value ratio by the banks has today grown that have pushed more investor away. The low rate of property development and investment in the portfolio has prompted higher housing pricing. The industry has therefore gone down as established in the future forecasts pf the housing markets in contrast to the past decades.

Interest

The cost of borrowing and the interest rates are always linearly related, and so most of the buyers will feel threatened and discouraged. In most cases, in such circumstances, the demand for housing also falls. On the flip side, when there is a decrease in the interest rates due to money supply growth, the cost of using the houses comes down, and so there is an upshot in demand in housing markets (Panagiotidis and Printzis 2016, p.30). It has been established that the correlation between the loan interest rates and house prices is negative. It largely depends on the level of competitiveness of the banking sector.

There are six direct and indirect ways in the housing market is affected by the interest rates. The direct ways include the cost of capital by the user, the supply of housing and the prospects about the price improvements. Some of the indirect ways include; changes in the housing wealth, the effects on the credit channel on demand and, on consumption (Goda et al. 2017, p. 37). The prices of property may not ah a significant influence on the interest rates, but the vice versa has a massive effect. Interest is a crucial macroeconomic factor as its increase and decrease have a direct correlation to the housing market prices.

Inflation

The relative prices of housing are largely affected by inflation as proved by earlier research on the same. The rate inflation will always have an impact on the demand for the housing investments. There is a conspicuous variation in the trends in the housing portfolio depending on the rates of inflation. It has been previously found that for changes in inflation in either direction, there is often an upward trend in the in the price of the houses (Cooper and Dynan 2016, p.18). The research also found that the housing investment motives are stirred when there is an increase in inflation, this because the real user costs decrease after taxes. The divergent view has, however, sparked on the correlation between inflation and the housing marketing industry with some researchers holding high inflation leads to little property demands and other opposing the observation (Mohd et al. 2016, p.22). There have therefore been discordant positions about the actual effects of inflation on housing and marketing as based on research conducted in Manchester in 2016 by Mohd and his colleagues.

Employment

The housing markets are also influenced by the household income and rates of employment. These two are tied together not only in the UK scenario but also in other industrialized economies. According to research on the same, the activity on the housing markets considerably scales down when the rate of unemployment is high (Yunus 2015, p.4). The growth rate in the industry therefore largely come down. These research conclude that when the unemployment rate increase by one percentage unit the housing prices also scales down by 1% as was witnessed in the UK before the economic liberation. Employment and demand in the property markets are congruent, and an upshot in either leads to an escalation of the other. The UK has enjoyed a high employment rate in the past decade that has seen the housing markets stabilize in the past five years to 28% in 2016 (Baptista et al. 2016, p. 12). The prolonged political instabilities and breakaway from the economic trade pact with the rest of other European countries resulted in a feeble local economy that led to lower employment rates. The housing markets have also experienced the heat of the unemployment leading to lower forecasting of the portfolio at 14.2% in the next five years. From these incidences, home ownership is connected to the labor mobility. Evidence show that there is a negative externality on property markets based on the labor market. When the rate of home ownership increases, the labor mobility is affected and so the unemployment rate increases.

Demographics

The housing markets are also affected by the human demographics. In the past when the birth rate was high in the UK, the increased number of newborns would have a short term effect on the property markets. This is because birth rate prompts an increase in demand for the housing units at least in the next 20 years (Tsai and Tsai 2018, p.10). This is because in future the average age of the population will influence demand for the prices in housing regardless of decreased birth rates at the time. The housing prices that have scaled up in the recent past also corresponds to the increase in the average human population in the country with people in the 20s to late 30s seeking more residential homes and investments in the property markets.

The research Methods

This research finds its data from the macroeconomic evaluation of Housing markets in the UK and Germany. The data represented here is valid and reliable. The table shows the results when six independent variables were exposed to regression and analyzed based on the model of the nominal prices of houses, HP, which was picked as the dependent variable.

| Dependent Variable: HP | ||||

| Method: Least Squares | ||||

| Date: 03/28/18 Time: 16:12 | ||||

| Sample: 1 18 | ||||

| Included observations: 18 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | -254.6714 | 32.61208 | -7.809112 | 0.0000 |

| DIS | 0.146985 | 0.665337 | 0.220918 | 0.8292 |

| GDP | 2.00E-10 | 1.39E-11 | 14.42478 | 0.0000 |

| INF | -0.052845 | 1.254057 | -0.042140 | 0.9671 |

| LR | 6.526956 | 1.991179 | 3.277936 | 0.0074 |

| SR | -0.687136 | 0.889830 | -0.772211 | 0.4563 |

| UNEM | 2.005806 | 1.507665 | 1.330405 | 0.2103 |

| R-squared | 0.990526 | Mean dependent var | 86.01552 | |

| Adjusted R-squared | 0.985358 | S.D. dependent var | 23.44713 | |

| S.E. of regression | 2.837213 | Akaike info criterion | 5.208823 | |

| Sum squared resid | 88.54757 | Schwarz criterion | 5.555079 | |

| Log-likelihood | -39.87941 | Hannan-Quinn criteria. | 5.256567 | |

| F-statistic | 191.6721 | Durbin-Watson stat | 1.606059 | |

| Prob(F-statistic) | 0.000000 | |||

The data from the UK was collected on a quarterly basis from World Bank, Bloomberg, OECD and across the nation (Ljubljana, n.d). The information about the macroeconomics in the data current and relevant since it was collected on a quarterly basis across the year. It is not a single summary of the related annual data. It is therefore rich in the desired information to give a conclusive result in the analysis.

The quantitative analysis of the data was achieved through Eviews, which largely involved the Coefficient Analysis, Ramsey Reset Test, Integration, and Cointegration. The coefficient analysis largely entailed the analysis of the size and sign of the dependent variable with regards to the independent variable. The significance of the coefficient is also estimated through a T-test.

The Ramsey Rest Test examines correct specification of the model and highlights the omitted variables. Some of the possible model misspecifications include; bias in the slope coefficients, bias in the estimated intercepts, Variance of the slope, standard error, the incorrect hypothesis tests for t and F test and also finds out if the errors in forecasting (Felix, n.d).

The Integration analysis observes if the data is stationary. It if it finds the data to be nonstationary then it is integrated. It uses three approaches in determining stationarity; Graphical analysis, Correlogram and the Unit root test. The characteristics of both the stationary and non-stationary time series are as shown in the correlogram below.

| ACF | Q-stat | Probabilities | |

| Stationary | Low values and no discernible pattern | Lower than X2 at any lag | The probabilities of finding such Q-stat differ from zero |

| Non-stationary | Values start high and decline gradually | Higher than X2 at any lag | “ “ equal to zero |

The cointegration analysis is essential in the observation of the relationship between the dependent and the independent variables and evaluates if the tow is balanced in the long term. The Eagle Granger test is the performed with the view to observe if the model is perfectly cointegrated or not. This process uses a simple rule that should the values of |tau stat |<ADF exist then the variables should be conintegrated because they are not.

The Findings of the influence of the Macroeconomic variables on the Housing Markets

The analysis of the coefficients

The equation of the population model is shown below based on the earlier identifies dependent variable

HP = 1GDP + 2DIS + 3UNEM + 4SR + 5INF + 6LT

The equation for performing the quantitative analysis is as follows:

= 1GDP + 2DIS + 3UNEM + 4SR + 5INF + 6LT

The estimated equation is solved to the below, and regression results are as stipulated in the table.

= 1GDP + 2DIS + 3UNEM + 4SR + 5INF + 6LT

| Dependent Variable: HP | ||||

| Method: Least Squares | ||||

| Date: 02/21/18 Time: 14:47 | ||||

| Sample: 1 112 | ||||

| Included observations: 112 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | -316897.1 | 38130.67 | -8.310820 | 0.0000 |

| GDP | 1.183430 | 0.100761 | 11.74490 | 0.0000 |

| DIS | 0.595039 | 0.148661 | 4.002646 | 0.0001 |

| UNEM | 8918.662 | 849.2239 | 10.50213 | 0.0000 |

| SR | 2604.278 | 574.6409 | 4.532009 | 0.0000 |

| INF | -2698.317 | 421.8664 | -6.396140 | 0.0000 |

| LT | 3228.903 | 1101.810 | 2.930543 | 0.0042 |

| R-squared | 0.985136 | Mean dependent var | 116293.7 | |

| Adjusted R-squared | 0.984287 | S.D. dependent var | 54894.12 | |

| S.E. of regression | 6881.104 | Akaike info criterion | 20.57141 | |

| Sum squared resid | 4.97E+09 | Schwarz criterion | 20.74131 | |

| Log likelihood | -1144.999 | Hannan-Quinn criter. | 20.64034 | |

| F-statistic | 1159.855 | Durbin-Watson stat | 0.268322 | |

| Prob(F-statistic) | 0.000000 | |||

From the findings, it can be noted from the sign that both the dependent and the independent variables are positively correlated except in the case of inflation. It is therefore affirmative to say that the housing markets are linearly related to other variables such as interest rates, GDP, unemployment, and income.

Discussions

The discussions show the variations of the independent variable with the dependent variable as noted from the regression results. Precisely, it examines the variations of the macroeconomics with the housing markets in the UK.

GDP

From the coefficient, it can be seen that a positive GDP is a sign of economic growth it therefore positively impact on the prices of houses. The purchasing ability of the population of the homes increases with an increase in the GDP. The converse also holds as noted from the results.

Inflation

It is the only variable with a negative correlation with the housing prices based on the result of the model. The inflation in the UK has always been managed. The spending of the population, however, goes down when the inflation level is high and therefore develops a negative impact on housing markets.

Disposable income

The variable has a linearly positive variation with the housing prices as can be seen from the results. Similar results have also been obtained similar parallel research. Whenever the disposable income of the UK citizens increase, they tend to buy more houses because they can close the gap and invest in the markets. The housing markets are largely affected by the incomes that the pricing immediately rise with an increase in the citizen’s disposable incomes.

Unemployment

High employment rates imply that most people in the UK have access to finances. Increased unemployment is an indication of limited access to finances. Unemployment is positively correlated to the property markets as established in the regression results. Some other earlier research, however, a negative variation of the variable with the housing markets. This explained in that when few people have employed the demand for housing deescalates. It, therefore, prompts the housing prices to decrease. The positive correlation is attributed to unemployment and the owner-occupier rate. The two are positively correlated because of the lower mobility labor when it comes to transportation by the owners. The employability of the renters increases since they can easily change their residence. They can thus instigate increased occupier rate thus causing an increase in unemployment. The rate in these dynamics is higher in contrast to that of the average European population thus explaining the validity of the results and the earlier theoretical projects.

Interest rates

The regression results of the unemployment and interest rates being congruent to the housing prices in the UK is intriguing. A study conducted in 2012 on the same came up with a negative correlation between long and short term interest rates and the housing prices in the UK. When the interest rate is high, the amount of money in circulation decreases the country’s currency, however, appreciates due to the scarcity of liquidity. The purchasing power of the people is reduced thus explaining the negative correlation of the variable with the house prices. Without observing the short and long term analogy, the interest rate has a positive correlation with the house prices in the UK as the regression results provide.

Conclusion

It is observable from the regression results that the macroeconomics with the strongest impact on the UK housing markets are the GDP, disposable income, and inflation rates. It is notable that they have stronger coefficients showing the stronger correlation with the housing markets. The variables tend to dissuade investors and government that despite interest rates and unemployment in the having a positive correlation with the housing prices they do not have a massive influence on the housing prices and thus should not be much of a concern as can observed from the model.

List of references

Baptista, R., Farmer, J.D., Hinterschweiger, M., Low, K., Tang, D. and Uluc, A., 2016. Macroprudential policy in an agent-based model of the UK housing market.

Business Insider, 2017. House Prices. Retrieved from http://uk.businessinsider.com/uk-house-prices-will-they-rise-or-fall-in-2019-2017-9?IR=T

Clair, A., Loopstra, R., Reeves, A., McKee, M., Dorling, D. and Stuckler, D., 2016. The impact of housing payment problems on health status during an economic recession: A comparative analysis of longitudinal EU SILC data of 27 European states, 2008–2010. SSM-population health, 2, pp.306-316.

Cook, S. and Holly, S., 2014. Statistical properties of UK house prices: An analysis of disaggregated vintages. Urban Studies, 37(11), pp.2045-2051.

Cook, S. and Watson, D., 2016. A new perspective on the ripple effect in the UK housing market: Comovement, cyclical subsamples and alternative indices. Urban Studies, 53(14), pp.3048-3062.

Cook, S., 2012. β-convergence and the cyclical dynamics of UK regional house prices. Urban Studies, 49(1), pp.203-218.

Cooper, D. and Dynan, K., 2016. Wealth effects and macroeconomic dynamics. Journal of Economic Surveys, 30(1), pp.34-55.

Felix Schindler, 2017. How efficient is the UK housing markets? Retrieved from ftp://ftp.zew.de/pub/zew-docs/dp/dp10030.pdf

Goda, T., Onaran, Ö. and Stockhammer, E., 2017. Income inequality and wealth concentration in the recent crisis. Development and Change, 48(1), pp.3-27.

Gray, D., 2015. Are prices for New dwellings different? A spectral analysis of UK property vintages. Cogent Economics & Finance, 3(1), p.993860.

Gray, D., 2017. Convergence and divergence in British housing space. Regional Studies, pp.1-10.

Haldane, A.G. and Turrell, A.E., 2018. An interdisciplinary model for macroeconomics. Oxford Review of Economic Policy, 34(1-2), pp.219-251.

Healy, J.D., 2017. Housing, fuel poverty, and health: a pan-European analysis. Routledge.

Hinch, M., Berry, J., McGreal, W., and Grissom, T., 2015. LIBOR, base rate spreads, and the UK housing market. International Journal of Housing Markets and Analysis, 8(1), pp.118-134.

Knight Franc, 2017. Housing Market Forecast. Retrieved from http://content.knightfrank.com/research/367/documents/en/uk-housing-market-forecast-december-2017-5137.pdf

Li, R.Y.M., and Chau, K.W., 2016. Econometric analyses of international housing markets. Routledge.

Ljubljana, 2016 Ten New Propositions in the UK Housing Macroeconomics. Retrieved from https://www.enhr.net/documents/2006%20Slovenia/PV_geoffrey.pdf

Meng, H., Xu, H.C., Zhou, W.X. and Sornette, D., 2017. Symmetric thermal optimal path and time-dependent lead-lag relationship: novel statistical tests and application to UK and US real-estate and monetary policies. Quantitative Finance, 17(6), pp.959-977.

Mohd Yusof, R., Bahlous, M., and Haniffa, R., 2016. Rental rate as alternative pricing for Islamic home financing: an empirical investigation on the UK Market. International Journal of Housing Markets and Analysis, 9(4), pp.601-626.

Nuuter, T., Lill, I. and Tupenaite, L., 2015. Comparison of housing market sustainability in European countries based on multiple criteria assessment. Land Use Policy, 42, pp.642-651.

Panagiotidis, T. and Printzis, P., 2016. On the macroeconomic determinants of the housing market in Greece: A VECM approach. International Economics and Economic Policy, 13(3), pp.387-409.

Stockhammer, E., 2015. Rising inequality as a cause of the present crisis. Cambridge Journal of Economics, 39(3), pp.935-958.

Strohsal, T., Proaño Acosta, C. and Wolters, J., 2015. How do financial cycles interact? Evidence from us and the UK (No. 2015-024). SFB 649 Discussion Paper.

Strohsal, T., Proaño Acosta, C. and Wolters, J., 2015. How do financial cycles interact? Evidence from us and the UK (No. 2015-024). SFB 649 Discussion Paper.

Strohsal, T., Proaño, C. and Wolters, J., 2015. Characterizing the financial cycle: Evidence from a frequency domain analysis.

Tsai, H.C., and Tsai, I.C., 2018. Market depth in the UK housing market. Economic Research-Ekonomska Istraživanja, 31(1), pp.406-427.

Tsai, I.C., 2015. Spillover effect between the regional and the national housing markets in the UK. Regional Studies, 49(12), pp.1957-1976.

University of Reading, 2013. Retrieved from http://centaur.reading.ac.uk/31493/1/31493.pdf

White, M. and Taltavull de La Paz, P., 2015. House prices and macroeconomic implications. Current knowledge.

Yunus, N., 2015. Trends and convergence in global housing markets. Journal of International Financial Markets, Institutions, and Money, 36, pp.100-112.