Executive Summary

The purpose of this study is to examine a company named ‘JCPenney” which is known as one of the market leaders in America for its superior services. This report will provide a thorough analysis of the external and internal factors contributing to the success of the firm and will also provide various recommendations on how it can improve its strategy to attract more and more customers and generate more revenue.

Company History

Background

The company in view was inaugurated in by James Cash Penney as retailer store of goods in 1992. It is now famous all over America for its vast chain of departmental stores all across the country. The company includes a broad range of products including outfits, makeup items, electronics, shoes, furniture, kitchen equipment and all sorts of jewelry items. JCPenney also has a lot of individual departments like Sephora Makeup, optical centers, Seattle’s Best Coffee and various picture studios, along with repair shops for jewelry and registry outlets for wedding ceremonies, etc. The company mainly operates in the USA and Puerto Rico with 1,107 stores.

Purpose of the study

The theme of the report is to find out how the external and internal environmental factors like the company’s competitors, suppliers, and customers along with its employees and senior management shape up its success in the market. The study will provide some recommendations for the industry after analyzing these factors to help make the company more successful in the long run.

External Analysis

General Environmental Analysis

Demographic Segment

The primary target population are women especially mothers in the age group 35 to 45, with a family of 3+ members and belonging to middle-to-low class families.

Economic Segment

The clothing and departmental stores were hurt the most after the recession period. The Bureau of Economic Analysis (BEA) states that the individual proceeds, private consumption payments in the United States were at the improved amount of 0.4% in June 2014. It is a clear evidence of enhanced consumer expenditure patterns which can pose a change towards the procurements of products and triumph of the company.

Political/Legal Segment

The company’s associates are responsible and have an individual liability in case of breaching any laws. The company follows all standards for ensuring a better and safer environment and associated health and well-being concerns for individuals.

Socio-Cultural Segment

Consumers all over the world are moving towards online and mobile based shopping owing to ease of use and time-saving. JCPenney in that regard has launched a mobile app for its online store, but it has failed to capture consumer’s interests.

Technological Segment

JCPenney tries to capture all the target customers both online and via retail stores. By offering a mobile purchasing policy to its customers, JCPenney can extend its reach to thousands of clients. The also provides discounts and sale promotions on online purchases, thus enabling it to attract new and more buyers.

Summary of General Environment Analysis

The PESTEL forces can help pave the path for JCP stores if incorporated in the main strategies of the business.

Industry Analysis

Description of the Industry

The company has a vast web of stores spread all across the country. However, the increasing needs of the customers have shaped the narrow range of the retails stores into four different categories like Specialty stores, Department stores, Seasonal retailers and Discount Stores, etc.

Market Size

The main market segments are inner-city and peripheral areas of the Midwest U.S. with an estimated number of around 100,000 people.

Market Growth Rate

The company has a better ratio of 1.7 concerning its competitors. Having a current increased ratio as compared to its competitor shows that the business has a sturdier financial situation. The current assets are estimated to be around $4,833 million, with an improvement of 31.2%. Its current liabilities are estimated to be around $2,846 million. The company has a robust cash and liquidity spot which proves a strong suit for it when investing in any probable prospects.

Industry Trends

The biggest trends in the retail stores industry in 2010 are known to be:

- Stinginess and cognizant consuming patterns

- Heed towards environmental safe products and services, green amenities, and environmental preservation activities are immensely advertised and focused on by the U.S. retailers, attracting more customers.

- Integrating of latest technology including web-based shopping to cater to the needs of newer demographics.

- State of the art inventory management systems in retail stores for efficient warehouse management

Pop-up retailing

Five Forces Analysis

Threat of New Entrants

With technological advancements, the risk is high since many local manufacturers offer similar products at a lower cost online without incurring the costs of warehousing and selling and distribution networks.

Power of Suppliers

The company has around 2,700 local and overseas suppliers and aims to control the quality of its products and services by internationally purchasing subsidiary. The company further has various quality assurance offices in 11 different countries.

Power of Buyers

Some of the consumers enjoy shopping according to seasonal trends while some prefer buying off-season to avail sale lineups. These consumers tend to purchase thing in bulk for added significance. They are also the ones who focus on buying products through different deals and offers.

Intensity of rivalry

The main rivals like Kohl and Macy have identical characteristics offering the similar prices and promotional activities to the JCP stores. However, a difference the Kohl stores lack sheer customer facility networks like the JCP stores. Macy’s offers some of the high end commodities as well along with focusing on its famous brand image to appeal to the buyers. Macy’s also has a primary location and access to sponsored programs through which it tries to take up more customers. JCP has a historical base too, but it lacks access to sponsored events.

Industry Competitors

The primary competitors of the JCPenney include Macy’s Inc. and Kohl’s. Looking at the profitability ratios of the past three years, the toughest opponent was Macy’s when it comes to improved revenues and sale proceedings.

Rivals Anticipated Strategic Moves

Some of the rivals like Macy’s are launching a Thanksgiving Day Parade in its retail store at the Herald Square. Macy’s lacks the improved customer service like JCP stores but is immensely popular in customers because of such activities. A supplementary force for Macy’s is that it has endorsement and marketing deals with celebs. Many of holiday advertisements of Macy’s will now target a diversity of celebrities increasing the store’s appeal to its consumers. The promotional sales for holidays are also an excellent way to attract more buyers.

Summary of Five Forces Analysis

The company should make use of all these factors to gain more and more buyers and gain an edge over its competitors.

Industry Key Success Factors

Internal Analysis

Organizational Analysis

Internally speaking the company has a combination of in-house circulation and particular dissemination categories. The company mainly operates in the USA but has headquarters at Plano, Texas. It has around 147,000 employees.

Corporate Mission

Products and Services

JCP has a combination of various international and local brands. The company mainly wants to target the power brands which will appeal to more and more customers like Sephora 11, Worthington, Ralph Lauren, Olsenboye by the Olsen twins, A.N.A, Super Girl by Nastia Liukin and I Heart Ronson by Charlotte Ronson.

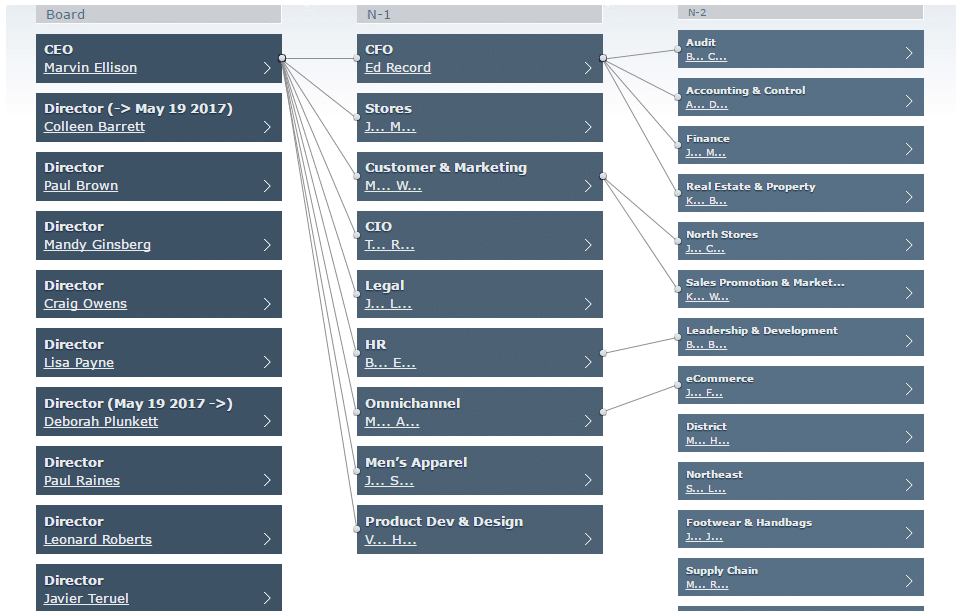

Leadership

The main leaders of the company include the Chairman of the Board & CEO called Mr. Marvin R. Ellison. While the EVP of the stores is Mr. Joe McFarland, Ms. Pam Mortensen is the SVP and the GMM of Fine Jewelry and Accessories while Katheryn Burchett is the SVP of Visual Environment & Corporate Strategy.

Organizational Culture

Overall the organization focuses on a Low power distance where employees follow an individualistic approach. JCP has a high uncertainty avoidance at middle management while its remains small at senior management who continually try new things to innovate. The company overall focusses on a long term orientation.

Structure

The hierarchy and structure of the main leads of the company are shown in the above table.

Strategy

The new CEO of the company highlight working in teams and incorporating better, more emphatic Long Range Plans to pave the path for business growth. It includes changes in the enterprise resources like reformed variations in the supply chains and distribution cores. It also included using a RFID system for the operation. The strategy, in turn, would help the company keep track of all its inventory and attract more consumers.

Summary of Organizational Analysis

The active leadership of the current CEO has carefully integrated all the internal factors like the employees and the upper management to work together seamlessly to attain JCP’s goals. Analysis of Firm Resources

Tangible and Intangible Resources

JCP’s Tangible assets are fixed assets are its manufacturing plants, the retail stores and inventory houses along with land and current assets like stock. Intangible assets include patents, trademarks, and copyrights along with the brand name. One of the best intangible resources regarded for the company is its chairman and CEO, Ron Johnson.

Summary of Firms Resources

Capabilities

Core Competencies and Sustainable Advantages

JCPenney’s central theme is to capture the interest of mothers especially homemakers to purchase their family items at reasonable prices. The primary skill of the company is its customer first strategy where it incorporates the use of sale promotions to attract more customers. Sale promotions enable buyers to gain the opportunity of an incentive along with motivating them to make a purchase decision they didn’t intend for.

Summary of Firms capabilities

The company is perfectly able to design newer strategies and attract more buyers with the increasing rates of proceeds and better strategic implications by its senior management in the long run.

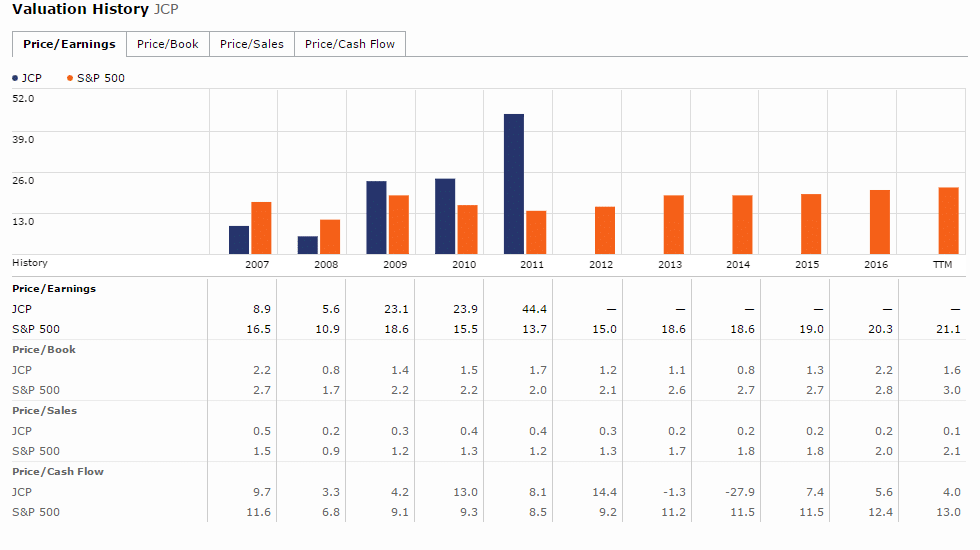

Valuation Analysis

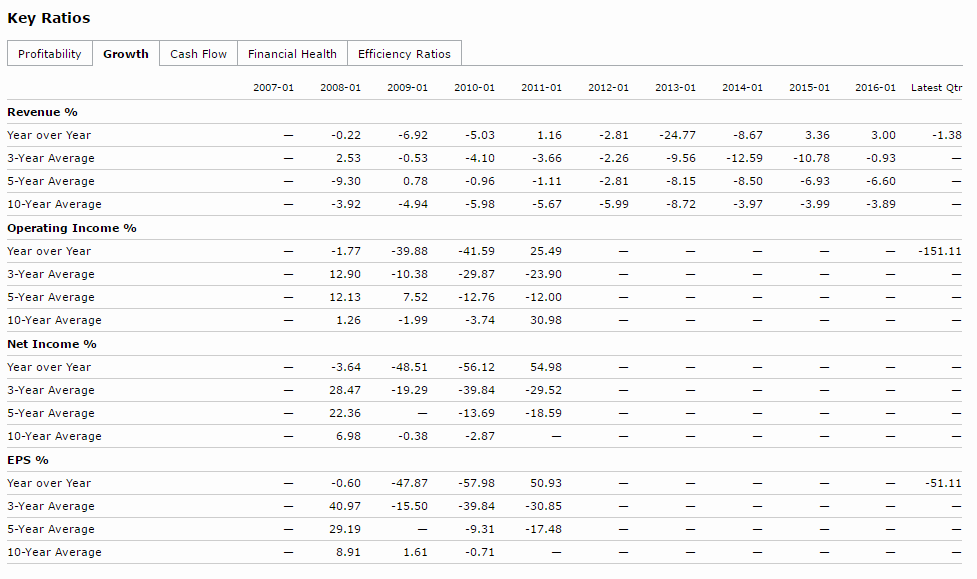

Growth Analysis

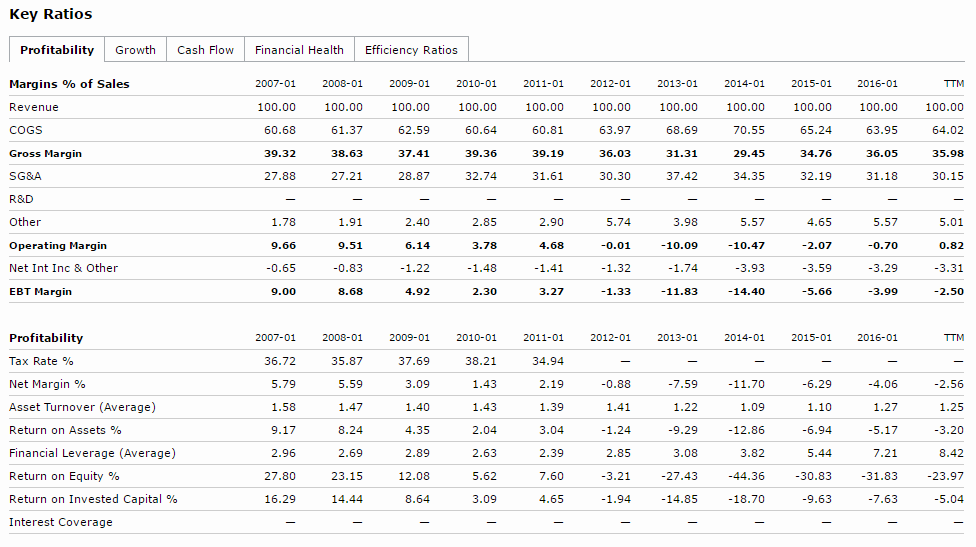

Profitability Analysis

Financial Performance

The past five years to the fiscal year 2015, JCPenney’s revenue reduced from 6.4% to $12.6 billion. It happened due to the recession which led to a decrease in consumer spending and buying behaviors. Along with a little revenue, the operating income also reduced. Speaking in financial terms, operating income decreased from $663 million in 2010 to $1.1 billion in fiscal 2015. It meant a 30% drop in revenue along with a direct forfeiture of $1.8 billion in past half decade.

Summary of Financial Analysis

The financial analysis shows that company can benefit by offering more value to its customers by providing various offers and discount promotions. The company can also attract more customers by providing the convenience of online shopping at the time anywhere from the web stores.

Strategic Issues Analysis

Critical Challenges

The company is known to have immensely increased rates of employee dissatisfaction and morale were found to be quite small with a very high turnover rate. The top rate of turnover is alarming since they charge the company with around one thousand dollars for every worker that leaves immediately after employee training. The cost adds up to more when the experienced workers leave. Additionally, the company only focusses on long term planning making no room for short-term planning skills.

Resources and Capabilities

JCPenney Company’s biggest attribute is how the customers are orientated. The customer first strategy of the company gives a company a significant competitive edge over its rivals since the primary focus of JCP is the needs of the client. Since, the company is following a long term approach it always welcomes new and innovative abilities with arms wide open, rendering it with a better position in the minds of the customers.

Strengths or Weaknesses Analysis

The key advantages of JCP include a state of the art supply chain, a unique selling and manufacturing approach, robust proceeds, and variety of product and services. However, the weak economic performance in the recession period and a deficiency in merchandise recall present challenges to the company. Reduced recall show product inferiority, leading to a weak brand’s image and greater operation overheads.

Opportunities or Threats Analysis

The company faces an imminent threat in the form of counterfeit products from local manufacturers along with an upsurge in workforce expenses, and continued rates of growth by its competitors. However, the rates of consumer spending in the U.S. have improved after the recession period opening up avenues of strategic investments for JCPenney.

References

- Ostlund, A. (2012). JC Penney Strategic Marketing Plan 2012: Product Strategy. Library.ndsu.edu. Retrieved 21 March 2017, from http://library.ndsu.edu/tools/dspace/load/?file=/repository/bitstream/handle/10365/19627/Alisha%20Liane%20Ostlund.pdf?sequence=1

- Thongkham, S. (2015). JC Penney Consumer Analysis -. Portfolios.journalism.ku.edu. Retrieved 21 March 2017, from https://portfolios.journalism.ku.edu/sookie-thongkham/2015/07/31/jc-penney/

- Growth, Profitability, and Financial Ratios for JC Penney Co Inc (JCP) from Morningstar.com. (2017). Financials.morningstar.com. Retrieved 21 March 2017, from http://financials.morningstar.com/ratios/r.html?t=JCP

- jcp investors. Ir.jcpenney.com. Retrieved 21 March 2017, from http://ir.jcpenney.com/phoenix.zhtml?c=70528&p=irol-govconduct_pf

- Penney, J. Org Chart JC Penney. TheOfficialBoard. Retrieved 21 March 2017, from https://www.theofficialboard.com/org-chart/jc-penney

- JCPenney: What Are Its Key Strategic Priorities for Fiscal 2016? – Market Realist. (2017). Marketrealist.com. Retrieved 21 March 2017, from http://marketrealist.com/2016/03/jcpenney-key-strategic-priorities-fiscal-2016/