History

The Emirates Telecommunication Corporation (Etisalat) was founded in 1976 as a joint–stock venture between a British Company, International Aeradio Limited, and United Arab Emirates (UAE) partners. In 1983, the ownership structure of Etisalat changed, with the UAE’s government holding sixty percent of the company’s shares and the remaining traded publically. Etisalat received Federal Law Number One from the UAE’s government in 1991, which allowed the company to provide telecommunications services, both wireless and wired, within and outside the UAE. Etisalat was, therefore, able to issue licenses relating to telecommunication services placing them with regulatory and control powers. However, for the purpose of securing the economy of UAE, the government retained its powers of regulating the telecommunication sector while Etisalat carried out other responsibilities such as licensing responsibilities for owning, manufacturing, and operating telecommunication equipment. The company has continued to build its telecom infrastructure through technology and innovation, establishing itself as the technology leader. Today, Etisalat is one of the major contributors to the growing economy of the UAE (Companie History, 2018).

Company Profile

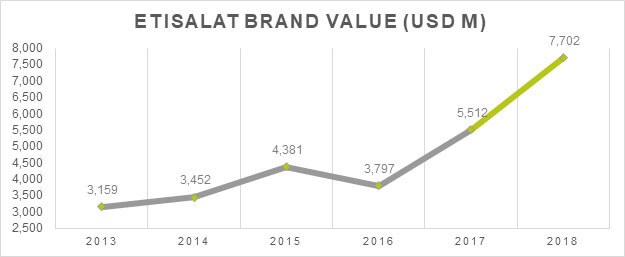

Etisalat has its headquarters in Abu Dhabi, UAE, focusing its operation on providing telecommunication services globally. The company has expanded its operation to media, equipment, contracting, and consultancy services to companies in the telecommunication sector. The company was the first in the United Arab Emirates but has recently received some competition in its industry. With nearly forty-two years of experience, Etisalat has expanded its operations in 16 countries in the Middle East, Africa, and Asia, which has made it the 14th largest network operator in the world. The company’s brand has continued to grow over the last five years, with its current value estimated to be $7.7 billion, making it the most valued brand in the Middle East and North Africa regions (Telecom Review, 2018).

Figure 1

The growth in the value of the brand has been associated with drivers such as the introduction of new digital applications, established flagship stores, and global brand-building initiatives such as partnerships with companies such as Manchester City Football Club.

Mission and Vision

The vision of Etisalat is to be the leading and most admired emerging markets telecom group. The company has various missions to help it in exploring its full potential in the telecom sector. One mission it aims at is providing the best in class customer experience for the retail and business sectors. The company is also on a mission to deliver attractive returns to its entire shareholders to improve its future investment opportunities. Additionally, Etisalat aims to support the economic development of its operating regions through job creation, Information Communication Technology (ICT), and socially responsible behaviors. The strategic pillars of the company are service offering, price, customer experience, operational excellence, portfolio, and people and culture (Etisalat, 2017).

The Telecommunication Industry in the UAE

The UAE leads other Middle East Arab countries in ICT since it has a well-developed infrastructure filled with technology and innovation. The two major competitors in the telecommunication sector in UAE are Etisalat and operator du. Estilat dominates the telecom sector in the region due to its long-term operational experiences both regionally and internationally. Operator du was only launched in 2007 and has less experience in the market than its latter. Competition in the telecommunication sector only increased recently, and Etisalat has always enjoyed a monopoly until recently. Another emerging competitor in the market of telecommunication in the UAE is Yahsat which was only launched in 2015.

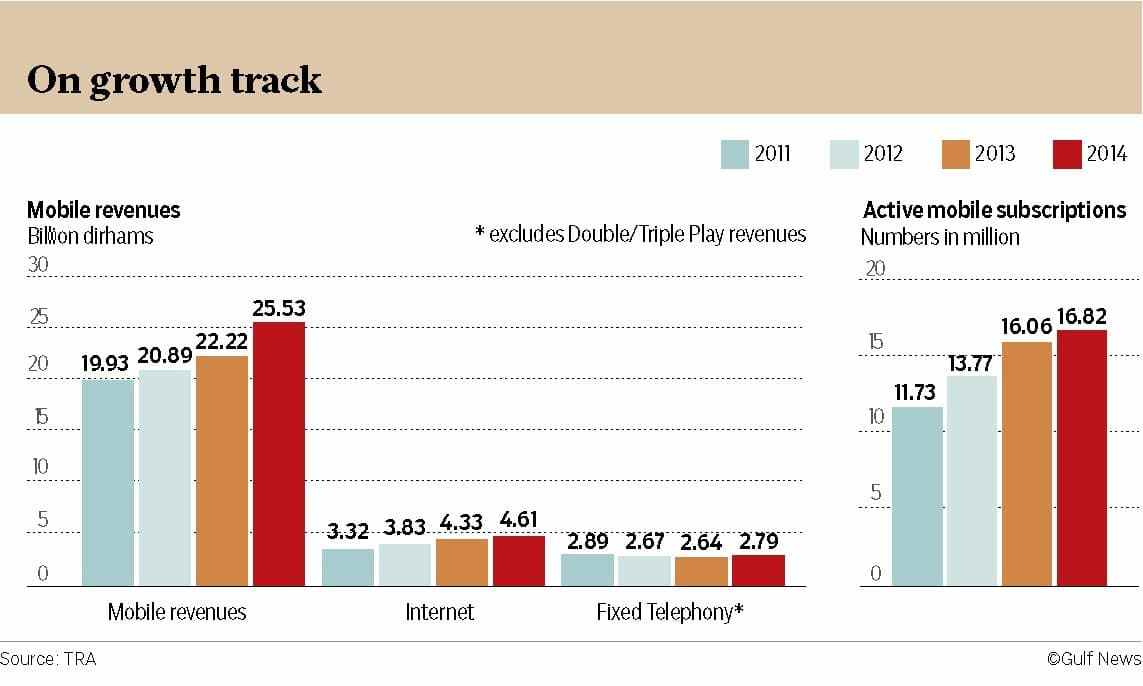

The Telecommunications Regulatory Authority (TRA) controls and supervises the telecommunication operators in the United Arab Emirates. From its formation in 1976 to 2006, Etisalat enjoyed a monopoly on its business and telecommunication services since they were the sole telephone and telecommunications provider, indicating the low level of competition that exists in the telecommunication industry in UAE. The drivers in the development of the telecom sector in the region include the economic growth of the country, foreign investment, and government initiatives. Due to a lack of competition, the high costs of telecom and costly manpower have become the major restraints for the development of the sector, but the emerging competitor is expected to facilitate the change that is required in the sector (ReportBuyer, 2015). However, the revenue for the telecommunication industry in UAE from 2011 has continued to increase showing that there are opportunities that exist for businesses that can venture into the sector.

Figure 2

Strategic Challenges for Etisalat

As Etisalat aims to become one of the leading and most admired groups, currency dealing with currency fluctuations is one of the major challenges that the company faces as it expands to other regions, especially developing countries. The price strategy applied by the company also poses a challenge in areas associated with heavy taxation and the presence of many operators. One of the pillars of the company’s strategy is one company. The tactics behind the one-company strategy are to carry out the company’s operation as outlined by the headquarters in Abu Dhabi. Although the strategy seems to work in the region, this is due to the monopoly that it enjoys in the UAE. In other countries where stiff competition exists, price strategy poses a challenge, which hinders the firm from fulfilling its vision. The emergence of competitors in UAE has also posed a threat as Etisalat tries to maintain its dominance in the Middle East. Relying on its pricing strategy can lead to its downfall if the emerging competitors manage to create a competitive advantage for themselves in the region.

Although the strategic pillars of Etisalat have helped it gain a competitive advantage in the telecom industry, the decision-makers of the company need to decide whether it is time to initiate some changes. The telecommunication industry is not only changing in the UAE but worldwide as well. The use of innovation and technology will greatly help the firm maintain its competitiveness with the firm. The emerging competitors in the UAE further distort the monopoly leverage that the company used to enjoy in its native country. Some of the tactics applied by the corporation, such as customer focus and portfolio, can prove essential to achieving the vision of the company if well implemented.

Question 1: What risks does Etisalat put itself by basing most of its operations on cost leadership strategy, and what changes can be made to make it more effective?

Being the pioneer of the telecommunication industry in UAE, Etisalat based most of its operations on the pricing strategy. The pricing strategy worked from its formation in 1976 to 2006 because it was the only company in the UAE telecommunication industry. Etisalat applied premium pricing, which was vital for the company to harness maximum profit from its consumers. Premium pricing involves keeping the products or services’ prices high meant to encourage favorable perception among the consumers. Premium pricing is associated with luxury or monopoly in the market. Businesses that are expected to do well with such strategies are those that have gained a high competitive advantage over their competitors or those in a less competitive market. Profits can be maximized in such instances as customers are willing to pay more or there is no substitute for the product or service offered (Pride & Ferrell, 2016).

Previously, Etisalat used to enjoy the benefits of premium pricing due to monopoly. However, as the company aims to fulfill its vision and set objectives, the emerging competitors force Etisalat to consider fully relying on the strategy. Its inability to penetrate the developing countries’ telecommunication sector as successfully as it hoped as a result of many providers and high taxes is an indicator of a change in the strategy. If rising competitors like DU manage to successfully create a competitive advantage for itself, achieving the set objectives can prove to be a challenge.

Another risk that Etisalat faces by basing most of its operation on the premium pricing strategy is branding cost. Sticking to the premium pricing strategy will require a massive allocation of resources, especially where competition continues to increase. As long as the strategy is under implementation, a company would have to maintain the strategy through advertisements, promotions, and continuous investment programs to its tactics to ensure that consumers still view the product with the same value or more than before, which can prove to be quite hectic and challenge (Breetz, 2014).

Although some successful organizations have managed to maintain their premium brand strategy, Etisalat would have to be prepared to incur heavy costs on its brand. The fact that it has a mission in place to create value in the eyes of the shareholders further worsens the situation, as profit margins would have to be greatly improved. If Etisalat fails to maintain its premium pricing strategy, the company’s brand will lose recognition from the consumers, which can lead to failure to realize the desired vision.

Competition is a risk to Etisalat premium pricing strategy. Recently in UAE, the monopoly that the firm enjoyed is under threat. Companies like DU and Yahsat, who have emerged in the telecommunication industry, threaten the premium strategy. An increase in competition tends to lower the products and services being offered in the affected markets. Competitors tend to create a perception in the consumers that the products and services offered by the dominant organizations are not as valued as they used to be before the competition increased. Such perceptions can lead to a fall in the product’s price to a high level (Forder & Allan, 2014).

The emerging competitors in the telecommunication industry will tend to challenge by offering challenging prices in relation to those provided by Etisalat so as to try to gain a competitive advantage. Du has already started building its own consumer base and proves to be a threat to Etisalat. The company will need to initiate new tactics to retain its competitive advantage, dominance, and brand value in the telecom industry in the UAE.

Another risk that Etisalat is likely to encounter is the maintenance and growth of its sales volume. To maintain its value among stakeholders, the company will have to retain and grow its sales volume, which can be challenging with the changes in the telecom industry in the country. Pursuing the premium pricing strategy will require a firm to confine its selling efforts to the top competitor in the market. This, in the long run, tends to reduce the sales volume as the focus changes to quality rather than quality. Pursuing aggressive sales growth for such companies and the premium strategy becomes difficult, and many firms are usually forced to choose between quality and sales volume.

Etisalat is the top tier in the UAE telecom industry, which means that it will influence where competitors base the price for their services and products. However, sales volume is important for the company as it hopes to maintain its value to the stakeholders. The company has an advantage in that it is currently trying to expand to other geographical regions, which means it still has the opportunity to pursue its premium pricing strategy. The challenge would be maintaining its leadership role and dominance in its region of origin.

Etisalat is already making changes to the challenges associated with its pricing strategy. If the company can maintain and efficiently implement the strategy, it is likely to gain advantages such as entry barriers to competitors and high profit margins. The use of tactics such as technology, excellent operations, and creating a good customer experience is a good way of making the strategy work for its benefit.

However, the company needs to take into consideration the focus differentiation strategy. Already their current tactics are changing the strategy to a focus differentiation strategy as they add more unique features to the premium pricing strategy. The company can focus on changing its products and services by taking into consideration the demands of its customers. The company does not necessarily have to lower the price of its products and services, but by adding unique features such as innovation and quality, customers can help it maintain its quality and prices.

Question 2: How effective is the overall strategy of Etisalat as it aims to become the leading and most admired brand in the telecommunication industry?

Service Offering and Good Customer Experience

Although pricing strategy is the basis for all of Etisalat’s operations, the company has incorporated some tactics to support its overall role strategy. Offering services to its consumers with professional customer care personnel is one such tactic. The need came during the expansion of the firm to other regions where it received intense competition as a result of other competitors in the market. The customer care professionals handle any issue that the firm’s customers. Etisalat is continuously implementing innovative services and products such as the Internet Calling Plan, eLife Packages, and other digital services that allow online transactions, queries, answers, and help from professionals in the company (Everington, 2016). The tactics seem effective as Etisalat has managed to retain its premium price strategy outside the Middle East as it tries to expand to other regions.

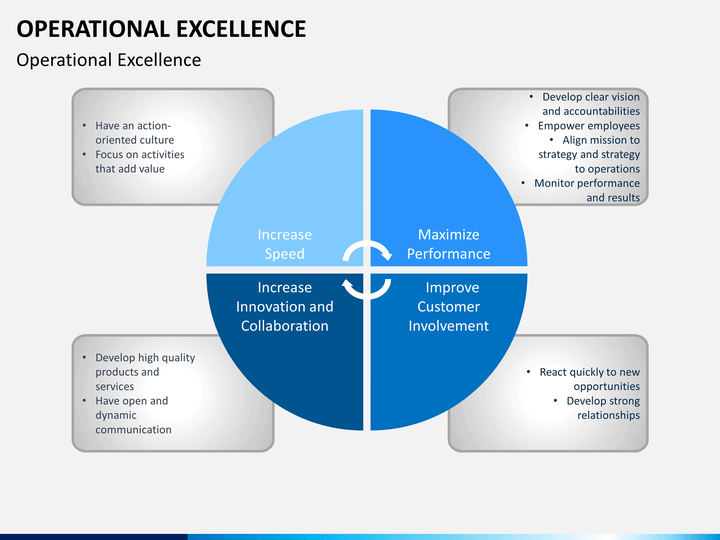

Operational Excellence

As Etisalat continues to expand into challenging areas, especially in developing countries such as Niger, the company tends to shift its strategy to customer focus differentiation. Etisalat focuses on its operation on excellence as it continues to adapt its activities to the culture and region which it operates. Recently, Etisalat refreshed its corporate strategy aiming to focus it towards the critical internal and external factors associated with the firm. The company indicated that it aims to adapt to the culture, people, and rapid consumption patterns in the telecom industry in different regions.

The company hopes to achieve the set objective by enhancing its customer experience through leveraging the in-depth knowledge of its consumers, launching platforms that allow consumer access to the telecom industry and the organization as well, and deploying the needed infrastructure that will enable customer access (Etisalat, 2017). Such tactics are required by organizations that are venturing into new geographical areas to help them better understand their customers and the challenges of their products and services in the region. The chart below summarizes what needs to be done for operational excellence to be achieved.

Figure 3

Shift to Focus Differentiation Strategy

The operation tactics for Etisalat seem to be shifting from pricing strategy to focus differentiation. Research indicates that a focus differentiation strategy involves a firm offering unique features to its products and services to fulfill the demands of a narrow market. As Etisalat expands its operations to Asia and North Africa, the firm seems to take a keen interest of its consumers in that specific geographical area by offering innovative products and services and customer care professionals to handle challenges facing the customers. Research indicates that approaches to the strategy include unique brand images, technology, features, channels, and customer service, among many more (Paluj, Kume, & Cipi, 2015). The tactics initiated by Etisalat reveal a change in the pricing strategy as the company expands to other regions. Focus differentiation has certain advantages such as customer loyalty, high profit margins, and minimal competition.

Corporate Social Responsibility (CSR)

Etisalat started implementing changes in sustainability and social responsibility strategy to facilitate its efforts toward better coordination of its global operations. The current CSR strategy for the firm includes support to the United Nations Global combat majorly focusing on environmental impact issues. Research indicates that the CRS strategy assists an organization in improving its public image in a region. Most of the consumers value companies that help in building the community and firms can create a good relationship with their customers by implementing CRS strategies that benefit the company and the community. Additionally, research has revealed that CRS strategies can assist companies to attract and retain investors in new geographical areas. Investors are attracted to firms that have sound business plans and a strong sense of corporate social responsibility (Doda, 2015).

Analysis of the CRS strategy of Etisalat seems effective, and it would facilitate the realization of becoming one of the emerging markets and leaders in the telecom industry. Etisalat has initiated tactics aimed at reducing the environmental impacts of its operations and customers. The firm has increased connectivity in its areas of operations and provided community-enriching services that provide value to the community, such as education and healthcare institutions. The firm’s Mobile Baby Program, for example, in Africa, is meant to support pregnant women in rural areas. The mobile health initiative was launched by Etisalat in conjunction with Qualcomm, D-Tree International, and Great Connection. In Africa, the company has already started creating value for itself in regions such as Tanzania and Nigeria due to the program (Etisalat, 2017).

Overall Efficiency of the Tactics Applied in the Strategy

Analysis of the tactics initiated by Etisalat reveals that they will assist the firm in realizing its vision of becoming the leading and most admired emerging markets telecom group in the world. The shift to focus differentiation and not solely relying on the premium price strategy will help the company become an emerging leader in the telecom industry. The tactic of creating a supplement strategy for the premium price strategy as the firm undergoes changes as a result of the expansion is effective. The focus differentiation strategy will help to expand the consumer base for the company, retain customers, and increase sales. The CSR strategy will assist Etisalat in attracting investors and building a good customer relationship with its customers in different regions. The CSR initiatives will be a vital tool for the firm in its aim of becoming the most admired emerging company in the telecommunication industry. Involving the communities in its operations and assisting in their development will assist in marketing and building Etisalat’s brand in new expansion areas. Operational excellence and good customer experience will be vital for the company to achieve its mission of providing the best in-class customer experience for the retail and business sectors to grow its sales volume. The future of Etisalat is full of challenges but the tactics and strategies will greatly help it to realize its overall vision.

Reference List

Breetz, C. (2014). “Product Packaging as Tool to Demand a Price Premium: Does Packaging Enhance Consumers’ Value Perception to Justify a Price Premium.” Anchor Academic Publishing.

Companie History. (2018). “Companies History.Com.” Retrieved March 11, 2018, from Etisalat: http://www.companieshistory.com/etisalat/

Doda, D. S. (2015). “The Importance of Corporate Social Responsibility.” Journal of Sociological Research , 215-230.

Etisalat. (2017). “Etisalat.” Retrieved March 11, 2018, from Investor Relations: http://www.etisalat.com/en/ir/corporateinfo/etisalat-strategy.jsp

Etisalat. (2017). “Etisalat.” Retrieved March 11, 2018, from Company Profile: Corporate Social Responsibility: http://www.etisalat.com/en/about/profile/etisalat-csr.jsp

Etisalat. (2017). “Etisalat.com.” Retrieved March 11, 2018, from Company Profile: http://www.etisalat.com/en/about/profile/company-profile.jsp

Everington, J. (2016, October 17). “The National Business.” Retrieved March 11, 2018, from Etisalat launches digital services unit: https://www.thenational.ae/business/etisalat- launches-digital-services-unit-1.156350

Forder, J., & Allan, S. (2014). “The impact of competition on quality and prices in the English care homes market.” Journal of Health Economics , 73-83.

Paluj, E., Kume, V., & Cipi, A. (2015). “The Impact of Generic Competitive Strategies on Organizational Performance. The Evidence from Albanian Context.” European Scientific Journal, 124-156.

Pride, W. M., & Ferrell, O. C. (2016). “Foundations of Marketing.” San Diego: Cengage.

Learning. ReportBuyer. (2015, October 20). “PR News.” Retrieved March 11, 2018, from Analysis of the Telecom sector in the United Arab Emirates (2008-2020)- Growth, Trends and Forecasts: https://www.prnewswire.com/news-releases/analysis-of-the- telecom-sector-in-the-united- arab-emirates-2008-2020—growth-trends-and-forecasts- 300163369.html

Telecom Review. (2018, February 14). “Telecomreview.com.” Retrieved March 11, 2018, from Brand Finance Ranks Etisalat as most valuable brand in MENA region:http://www.telecomreview.com/index.php/articles/telecom-operators/2050-brand- finance-ranks-etisalat-as-most-valuable-brand-in-mena-region

Appendix A

The global telecommunication industry has continued to grow especially the mobile industry. This is evident with the growth in the Smartphone and smartwatch sales. The growths in the products’ sales indicate a rising in opportunities for all the sub-sectors in the telecom industry, such as wireless and wireline carriers, network equipment companies, and device manufacturers. The industry further provides opportunities for mergers and acquisitions as a result of the changes in the regulations in the industry. The focus of consumers is shifting to quality, reliability, and affordability. Telecom operators, therefore, need to focus more on improving and reducing costs for their services and products if they hope to gain a competitive advantage in the industry.

Appendix 2

Figure 1: Etisalat Brand Value (USD M)

Figure 2: Telecom Industry Revenue Growth from 2011 to 2014 in UAE

Figure 3: Operational Excellence Chart