Case 1

Sparky Ltd is a business that employs some electricians. The business undertakes a range of work for its customers, from replacing fuses to installing complete wiring systems in new houses.

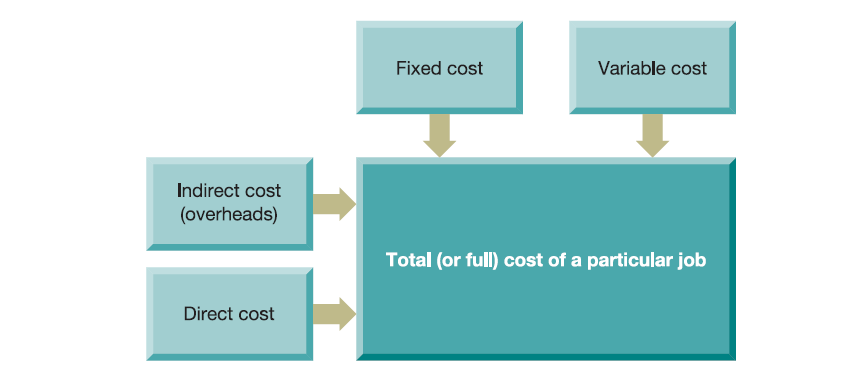

It is vital to take note of that whether a cost is immediate or aberrant relies on the thing being cost – the cost objective. To allude to aberrant cost without recognizing the cost objective is off base.

Normally, more extensive achieving cost goals, for example, working Sparky Ltd for a month, tend to incorporate a greater extent of direct cost than accomplish more constrained ones, for example, a specific occupation did by Sparky Ltd.

It merits underlining that the refinement amongst immediate and aberrant cost is just imperative in a vocation costing condition, that is, the place units of yield contrast.

Where we have units of yield that are not indistinguishable, we need to look all the more carefully at the make-up of the cost to accomplish a reasonable measure of the full cost of specific employment (Kramer, 2014).

How is the circuitous cost ought to be allotted to singular cost units?

It is sensible to see the backhanded cost (overheads) as rendering support of the cost units.

A lawful case, attempted by a firm of specialists for a specific customer, can be viewed as being rendered an administration by the workplace in which the work is finished.

In this sense, it is sensible to charge each case (cost unit) with an offer of the cost of running the workplace (lease, lighting, warming, cleaning, building upkeep et cetera).

It likewise appears to be sensible to relate the charge for the ‘utilization’ of the workplace to the level of administration that the specific case has gotten from the workplace.

The subsequent stage is the troublesome one.

By what means may the cost of running the workplace, which is a cost of all work done by the firm, be separated between singular cases that are not comparable in size and many-sided quality?

One probability is sharing this overhead cost similarly between each case took care of by the firm inside the period.

This strategy, be that as it may, has little to compliment it unless the cases were near being indistinguishable.

If we are not to propose break even with shares, we should recognize something discernible and quantifiable about the cases that we feel gives a sensible premise to recognizing one case and the following (James, n.d.).

Practically speaking, time spent taking a shot at every specific cost unit by coordinate work is the most well-known premise.

It must be focused on this isn’t the ‘right’ way, and it positively isn’t the main way.

For budgetary bookkeeping purposes costs are part of the accompanying classifications:

Cost of offers – otherwise called creation costs. This classification could incorporate creation work, materials, director pay rates and manufacturing plant lease.

Circulation costs – this incorporates offering and conveyance costs, for example, deals group commission and conveyance costs.

Authoritative expenses – this incorporates head office costs, IT bolster, HR support et cetera.

The least difficult grouping is part costs as indicated by component as takes after:

Materials – incorporates crude materials for a producer or then again the cost of merchandise that is to be exchanged in a retail association

Work – Labor expenses can comprise of fundamental pay as well as extra time, commissions and rewards too.

Different costs – otherwise called overheads. This incorporates power, deterioration, lease et cetera.

Backhanded expenses

Backhanded expenses are costs which can’t be specifically related to a particular cost unit or cost focus. Cases of circuitous expenses incorporate the accompanying:

aberrant materials – these incorporate materials that can’t be followed to an individual shirt, for instance, c

ircuitous cotton work – for instance, the cost of a chief who oversees the shirt creators

circuitous costs – for instance, the cost of leasing the processing plant where the shirts are fabricated.

Case:2

Bike LTD purchased ten bikes during January and sold six bikes, details of which are as follows:

January 1 Purchased five bikes @ $50 each

January 5 Sold two bikes

January 10 Sold one bike

January 15 Purchased five bikes @ 70 each

January 25 Sold three bikes

First in First Out (FIFO)

The estimation of 4 bicycles held as stock toward the finish of January might be computed as takes after:

The deals made on January 5 and ten were obviously produced using buys on first January. Of the deals made on January 25, it will be accepted that two bicycles identify with buys on January 1 while the staying one bicycle has been issued from the buys on fifteenth January (Channg, 2013). Consequently, the estimation of stock under FIFO is as per the following:

| Date | Purchase | Issues | Inventory | ||||||

| Units | $/Units | $ Total | Units | $/Units | $ Total | Units | $/Units | $ Total | |

| Jan 1 | 5 | 50 | 250 | 5 | 50 | 250 | |||

| Jan 5 | 2 | 50 | 100 | 3 | 50 | 150 | |||

| Jan 10 | 1 | 50 | 50 | 2 | 50 | 100 | |||

| Jan 15 | 5 | 70 | 350 | 5 | 70 | 350 | |||

| Jan 15 | 7 | 450 | |||||||

| Jan 25 | 2 | 50 | 100 | ||||||

| 1 | 70 | 70 | 4 | 70 | 280 | ||||

As can be seen from over, the stock cost under FIFO strategy identifies with the cost of the most recent buys, i.e. $70.

Last in First Out (LIFO)

The deals made on January 5 and ten were plainly produced using buys on first January. In any case, all deals made on January 25 will be accepted to have been produced using the buys on January 15. In this way, the estimation of stock under LIFO is as per the following:

| Date | Purchase | Issues | Inventory | ||||||

| Units | $/Units | $ Total | Units | $/Units | $ Total | Units | $/Units | $ Total | |

| Jan 1 | 5 | 50 | 250 | 5 | 50 | 250 | |||

| Jan 5 | 2 | 50 | 100 | 3 | 50 | 150 | |||

| Jan 10 | 1 | 50 | 50 | 2 | 50 | 100 | |||

| Jan 15 | 5 | 70 | 350 | 5 | 70 | 350 | |||

| Jan 15 | 7 | 450 | |||||||

| Jan 25 | 3 | 70 | 210 | 2 | 50 | 100 | |||

| 2 | 70 | 140 | |||||||

| 4 | 240 | ||||||||

As can be seen from above, LIFO strategy distributes cost based on most punctual buys first and final after stock from prior buys are issued is fetched from resulting buys apportioned. Hence, estimation of stock utilizing LIFO will be founded on obsolete costs. This is the reason the utilization of LIFO technique doesn’t take into consideration under IAS 2.

Average Cost Method (AVCO)

The estimation of 4 bicycles held as stock toward the finish of January might be figured as takes after:

All issues of stock will be accepted to convey the normal cost of all buys up to the date of the issue. The normal cost will be ascertained by isolating aggregate units of stock by the aggregate cost.

| Date | Purchase | Issues | Inventory | ||||||

| Units | $/Units | $ Total | Units | $/Units | $ Total | Units | $/Units | $ Total | |

| Jan 1 | 5 | 50 | 250 | 5 | 50 | 250 | |||

| Jan 5 | 2 | 50 | 100 | 3 | 50 | 150 | |||

| Jan 10 | 1 | 50 | 50 | 2 | 50 | 100 | |||

| Jan 15 | 5 | 70 | 350 | 5 | 70 | 350 | |||

| Average Cost of Inventory | 7 | 64.286 | 450 | ||||||

| Jan 25 | 3 | 64.286 | 192.858 | 4 | 64.286 | 257.144 | |||

As can be seen from above, AVCO strategy dispenses cost on the normal cost of buys amid the period. The normal cost of stock changes each time a buy is made at an alternate cost. In this way, the normal cost of stock changed from $50 to $64.286 after the buy on January 15.

Actual Unit Cost Method

It might be fitting to record stock of high an incentive at their real unit costs. This strategy is just down to earth where the quantity of stock things is little and recognizable, for example, in the property business.

L 002

2.1

Adjustable price per part = (Change in Entire Rate/Variance in Parts) = £3000/800 = £3.75

Settled Price = (£8000 – £3.75 × 2000) = £500

2.2

Performance Indicators, or KPIs, are essentially the measurements your business tracks keeping in mind the end goal to help decide the general relative adequacy of your business’ showcasing and deals endeavours. The colossal thing about KPIs is that you can design them to suit the necessities of your business and your groups. By breaking down these pointers, you can figure out what procedures are working and which ones aren’t, and modify your endeavours in like manner.

Cost per lead enables you to gauge the cost-viability of your showcasing efforts at producing new prospective customers. It assigns a dollar to add up to each lead your battle produces.

Client maintenance measures your business’ adequacy in holding clients over the long haul. The saying states that drawing in new client’s costs more than connecting with current clients; in this way, you’ll need to centre around this key execution pointer to help hone your business’ notoriety, client benefit process and general client encounter.

A degree of profitability enables you to gauge how much income is being created by a particular showcasing effort when contrasted with the expenses of running the battle. Return for money invested might be viewed as the most vital marker to screen and survey (Mathon, 2016). To track this KPI, you take the quantity of leads your crusade is creating, separated by the open door esteem, or your normal esteem per-win partitioned by your normal prompt win proportion.

2.3

Quality and dependability basic esteems for the bike business. In a where the oversights or of items or administrations have genuine results, it basic for us to have a structure set up to decrease dangers and keep on providing quality items and great support of our clients.”

Client needs

• Continual change in quality and adequacy items

• Increased effectiveness

• An establishment for multi-worldwide assembling

Client benefits

• Improved item quality lessened return rate

• License endorsement picks up in worldwide markets

• Continual change quality and assembling

L 003

3.1

The real motivation behind planning is to gauge the business, cost and costs of the association.

The execution of the organization can be estimated with the assistance of planning.

The spending makes the association conceivable to assess the accessibility of the assets in the organization (Alino and Schneider, 2012).

The earlier arranging of the monetary allowance is done to designate the assets of the association in a viable way.

Control can be kept up and checked in the association for the improvement of the tasks in all offices.

The financial backing arranged in the association gives the course to the organization for the accomplishment of the hierarchical objectives and goals.

The income of the organization can be anticipated ahead of time with the goal that the organization can use the accessible assets of the association (Alino and Schneider, 2012).

One of the essential components of the planning process is to take out or diminish the hazard in the matter of the organization.

3.2

There are one-of-a-kind budgeting methods which might be utilized in an enterprise. The organizations choose the correct budgeting strategies according to the desires and nature of the agency. A number of the techniques of budgeting are;

Fixed Budget:

In a static budget, the budget suggests outcomes for handiest one stage of a hobby, including production. Although that activity degree adjustments, the finances do now not. The fundamental process for fixed finance it’s far very simple: first, discover a base interest level. Then determine out what cost components you’ve got, identifying which can be bendy and which can be static. Subsequent, multiply the flexible fees by way of the hobby stage and upload the static expenses. Go away the finances alone for the whole budget duration regardless of the actual hobby stage.

Flexible Budget:

Bendy budgeting is the alternative of fixed budgeting. With this method, your business enterprise looks at more than one interest tiers and creates a sequence of static budgets, so the budget you operate accommodates what came about.

Zero-Based Budget:

Zero-based is a planning technique in which you begin starting with no outside help inevitably. To make this kind of spending plan, you make sense of your wage and your settled and adaptable costs. You at that point dispense a level of your wage to each cost, concentrating on the settled costs first. When you subtract the costs from your salary, the aggregate ought to be zero. On the off chance that it isn’t, it implies you need to alter your allotment.

Case 3

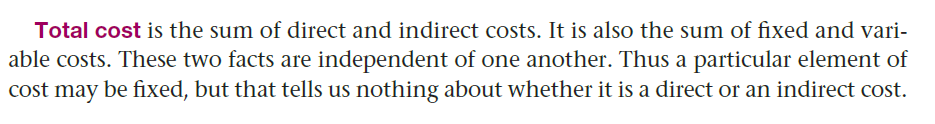

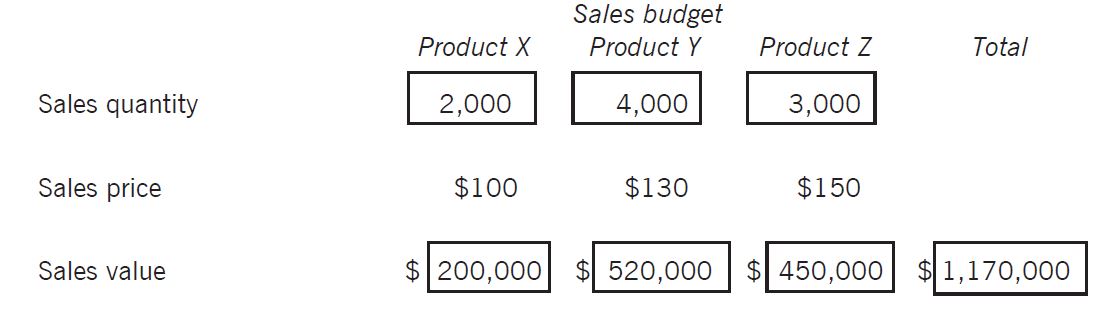

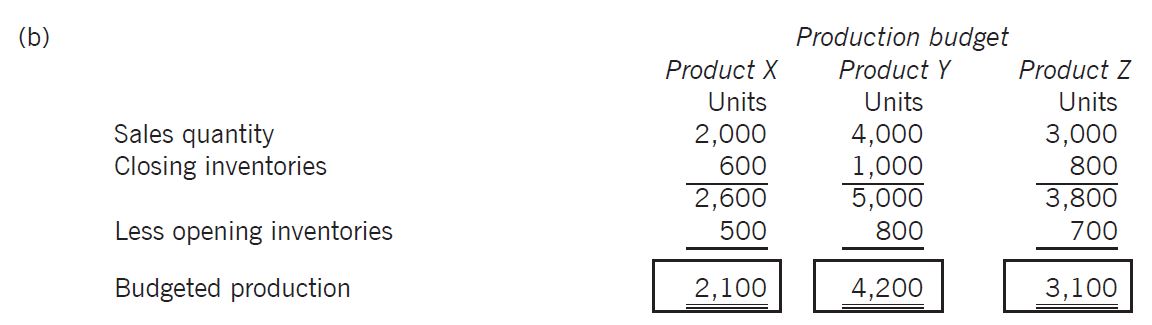

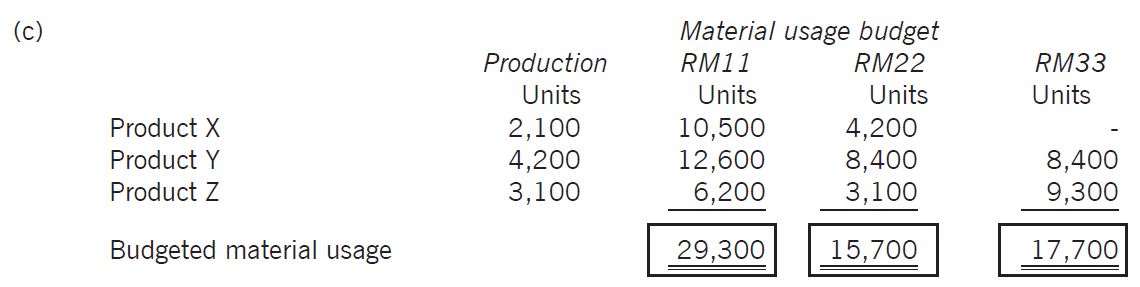

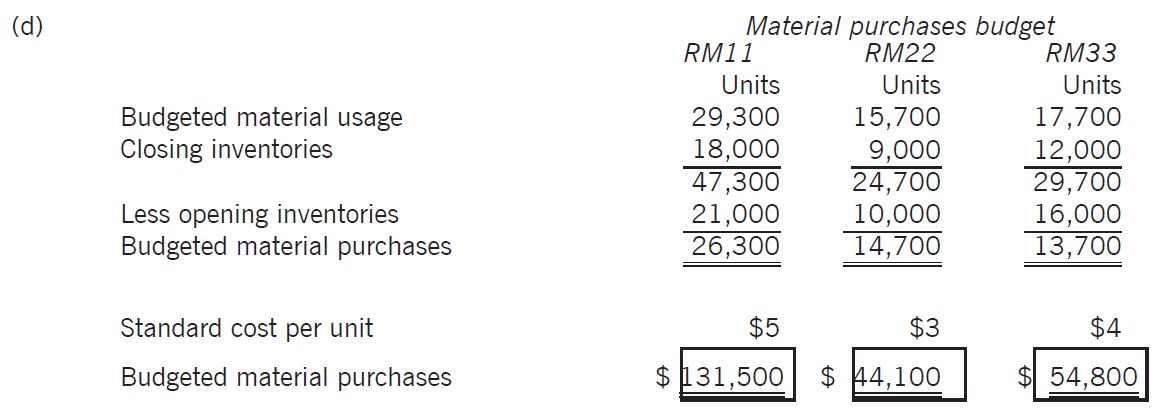

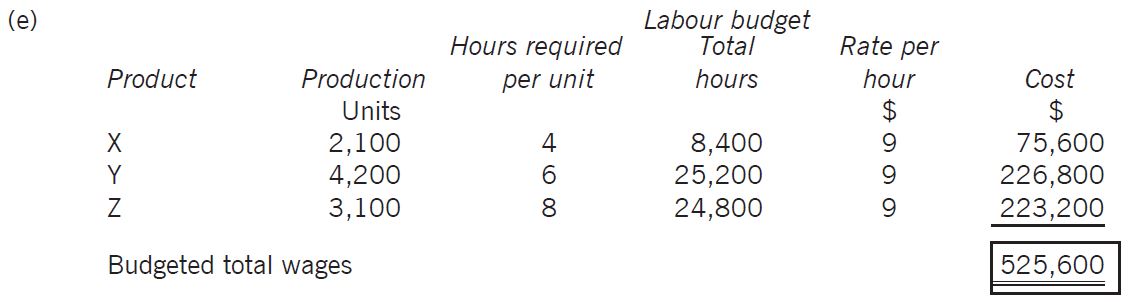

The XYZ company produces three products, X, Y, and Z. For the coming accounting period budgets are to be prepared using the following information:

Case 4

Calculate variances, identify possible causes and recommend corrective action.

Investigation of variances:

The aggregate change that we have figured for materials shows that the real use of materials was not $18 per unit. Notwithstanding, this could be either because we utilized the off-base measure of materials (which ought to have been 4 kg for every unit) or that we paid the wrong cost (which ought to have been $4.50 per kg). More probable obviously, it would be a blend of the two.

Conceivable causes: The value difference is positive with the genuine offering cost is not as much as standard cost. It might originate from the variance from the market cost or the markdown approach of the organization to draw in more clients as specified previously. The amount fluctuation is great too may because of the productivity of specialists has changed emphatically or the strict control of administrators.

The aggregate variable overhead change is good; this outcome may show the tight connection between the idea of direct work proficiency and variable overhead productivity. As a result of the strict supervision prompt the expansion in labour proficiency then the overhead brought about is not as much as the standard.

Operating statement reconciling

| Budgeted profit | 300 |

| Sale volume variance | 700 |

| Budgeted profit from actual sales | 500 |

| Selling price variance | 200 |

| Actual sales minus standard cost of sale | 460 |

Report:

In General, the genuine benefit is not as much as that of an adaptable spending plan. The reason which prompts this lessening is the offering cost in real is 190 which $10 not as much as that of an adaptable spending plan. This may originate from the opposition from others organization, or it is only the approach of the organization when they need to pull in more clients by diminishing the cost.

Conceivable reasons are as take after as:

1. The amount difference is ideal too may because of the proficiency of labourers has changed decidedly or the strict control of supervisors

2. The generation administrators may have strict supervision which diminishes the sit out of gear time of workers.

3. On account of the strict supervision prompt the expansion in labour proficiency then the overhead brought about is not as much as the standard

Proposals: The cost difference altogether is 111,116 which is great. This number shows phenomenal administration abilities of supervisors. In spite of the fact that the real offering cost is not as much as that of standard supervisors had balanced this by increment the work effectiveness; variable creation overhead proficiency and lessened others settled overhead. The last outcome is clear, the real benefits achieving the quantity of $143,620.

References

Channg, 2013. accounting-simplified. [Online]

Available at: http://accounting-simplified.com/financial-accounting/accounting-for-inventory/fifo-method.html

[Accessed 25 February 2018].

James, n.d. hndassignments. [Online]

Available at: http://hndassignments.blogspot.com/2017/02/hnd-assignment-on-management-accounting.html

[Accessed 25 February 2018].

Kramer, 2014. studentscholarships. [Online]

Available at: https://studentscholarships.org/salary/407/electricians.php#sthash.gXxSJQaQ.dpbs

[Accessed 25 February 2018].

Mathon, 2016. mindtools. [Online]

Available at: https://www.mindtools.com/pages/article/newTMM_87.htm

[Accessed 25 February 2018].