Dunkin’ Brands is a leading franchise company dealing in quick service restaurants that serve hot beverages, frozen drinks, baked goods, and ice cream (Brizek 4). The brand owns over 18,000 service points in more than 50 countries worldwide, with 11,000 restaurants under the Dunkin’ Donuts brand in 33 countries and 7250 Baskin-Robbins outlets in 50 countries (Brizek 4). The founder, William Rosenberg, opened the Open Kettle, in Quincy, Massachusetts in 1950, and later named it Dunkin Donuts. The company’s mission statement, which came straight from the founder, seeks to “make and serve the freshest, most delicious coffee and donuts quickly and courteously in modern, well-merchandised stores (Brizek 5).” Since the company rebranded to Dunkin’ Brands, it is guided by values including honesty, transparency, humility, integrity, respectfulness, fairness and responsibility (Dunkin’ Brands n.p). Dunkin’ guiding principles include leadership, social stewardship, execution, innovation and fun.

History of the Company

William Rosenberg opened his first restaurant, in Quincy, Massachusetts in 1948 and named it Open Kettle. He opened the coffee and donuts restaurant as an inspiration after observing that the two items were very popular in construction sites and factories in America. He later rebranded to Dunkin’ Donuts and opened his first franchise restaurant in 1955. In 1963, Dunkin’ opened its 100th restaurant, with Rosenberg’s son becoming the CEO at the age 25. The brand was then under the Universal Food systems, a conglomerate of small food businesses, but after 1963, constituent businesses of the conglomerate were closed and the restaurant rebranded as Dunkin’ Donuts. Alloyd Lyons, owner of Baskin-Robbins procured the Dunkin’ Donuts business and the two businesses combined in 1990 and by 1998, the company had expanded to over 2500 restaurants and $2 billion annual transactions. In 2004, the Dunkin’ headquarters moved to Canton Massachusetts and the brand was sold as Dunkin’ Brands in December 2005.

Structure of the Company

Dunkin’ Brands has a traditional hierarchy organization structure that is complex as it revolves around the products and functions of the restaurants and the franchises, and the many geographical locations where the restaurants are located (Burke 3). The structure has recently evolved to a matrix and multinational structure where information flows through digital means of email and video conferencing and the structure focuses less on hierarchical power and more on trust, the credibility of information and the results (Burke 3). The board of director consists of ten members with Nigel Travis as the overall Chief Executive Officer, Raul Alvarez as the lead director, Carl Sparks, Linda Boff, Irene Chang Britt, Anthony DiNovi, Michael Hines, Sandra Hobarch, Mark Nunnelly and Roland Smith (Burke 3).

Under the CEO serves the Chief Financial Officer, the official in charge of communications and sustainability, the heads of international operations, the Chief Information Officer and the official in charge of the legal operation and human resources. Other national and international divisions include culinary, franchising, marketing, enterprises, innovation, and supply. Due to the location of the restaurants and franchises, the structure has been flattened to eliminate hierarchy, and most information flow depends on trust between the regional and divisional heads (Burke 3).

The Marketing and Distribution Strategies of the Company

Dunkin’ Brands Group competes in the quick service restaurant field through the Dunkin’ Donuts brand for baked goods and the Baskin-Robbins brand for ice cream goods (Pilch 22). Its growth strategy focuses on increasing the average store sales in the US market, its expansion in the West Coast and the expansion in the emerging Asia Pacific and high-value markets in Europe (Pilch 22). Dunkin’ Brands majorly relies on the traditional marketing strategies of television, radio, and points of purchase despite the major shift by companies towards digital marketing strategies. The brand further uses the Facebook and Twitter platforms to engage guests, answer queries and offer information on new products and services. Furthermore, Dunkin’ Brands launched an app in 2014 where customers can order and pay for snacks, and at the same time, the corporation can keep tabs easily on the popular foods and beverages, as a marketing strategy to balance sales (Pilch 22).

Dunkin’ Brands further does geo-targeting, and offers products based on geographical space preferences, for example, offering more hot beverages in cold regions and frozen drinks in hot regions (Pilch 23). The data collected through mobile apps will inform the direction of innovations and new items added to the list of food options. Dunkin’ Brands operates with the mobile app, the DD card and the loyalty programs to keep track of visitations and offer favorite items on the menu as a means to keep people coming in and expand the customer base. Unlike its main competitor Starbucks, Dunkin’ offers quality but low priced qualities just above the accepted minimum, enabling it to serve the larger middle-class group (Pilch 23).

Financial Data

The current share price on 1st April 2018 for the Dunkin’s Brand Group Inc. stands at $59.69. This is as the share prices attempt to stabilize after a drop from its one-year high of $68.45 on the 25th of January 2018.

Source: (Dow Jones, n.p)

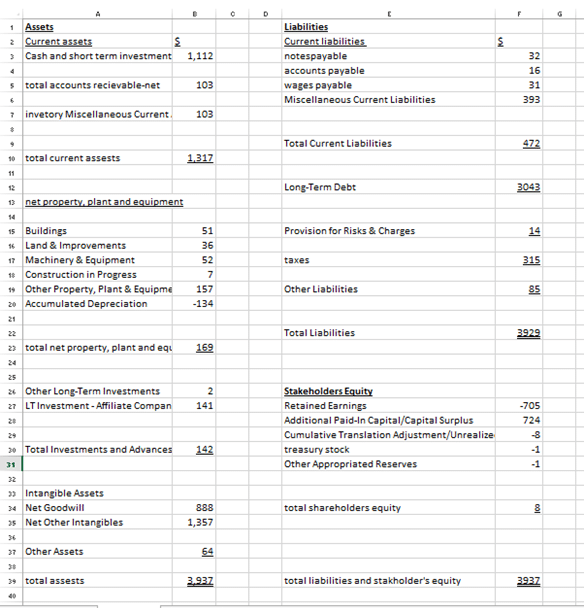

(All the values are in USD million. Also, some values have been rounded up to the nearest whole number, this explains the final imbalance)

The listed assets for the Dunkin’ Brands Group include prepaid expenses, account receivable assets, cash, and short-term investments, property, equipment, plant and land assets, intangible assets like goodwill, investments, and advances. On the other hand, the listed company liabilities include long-term debts, accumulated wages, and miscellaneous current liabilities.

The Dunkin’ Brands Group Income Statement

(All values are in thousands except the per share values)

From the full year results for the Dunkin’ Brands group, the company posted a net income of $350.9 million. This is 79.4% more in comparison to the previous year (Dow Jones n.p). The main expenses accrued by the company include the acquisition of general supplies and goods processed for sale, expenditures on sales and administration of day-to-day activities.

Interesting facts

Institutional investors hold 93% of the company’s outstanding shares, majorly because of the 100% franchise model where revenue is derived from royalties and franchise (Dunkin’ Brands n.p). This leaves the brand with very little operational advantage. The annual net income for the Dunkin’ Brands Group Inc. rose by 79.42% between 2016 December and 2017 December, which was a big margin compared to the previous financial years(Dunkin’ Brands n.p).

I would invest in the company as it has a vigorous and aggressive plan to grow and dominate the beverage industry in the USA. The business strategy set up by the company appeals to its customers; as a result, the company has witnessed continuous growth annually in terms of income and geographic expansion to reach a larger customer base. This reassures me and other potential investors of favorable profits.

Works cited

Brizek, Michael G. “Coffee wars: The Big Three: Starbucks, McDonald’s and Dunkin’’ Donuts.” Journal of Case Research in Business and Economics 5 (2014): 1.

Burke, Mark. “DUNKIN’’ DONUTS May 2012.”

Dow Jones, a News Corp Company” DNKN Financial Statements – Dunkin’ Brands Group Inc. – Wall Street Journal”. Quotes.Wsj.Com, 2018, http://quotes.wsj.com/DNKN/financials. Accessed 1 Apr 2018.

Dunkin’ Brands. “Home | Dunkin’ Brands”. Dunkin’ Brands.Com, 2018, HTTP://www.Dunkin’brands.com. Accessed 1 Apr 2018.

Pilch, Christine L. “Find Your Market Niche and Build a Stronger Brand.” Businesswest, vol. 23, no. 13, 16 Oct. 2006,

More Read: BEST EMAIL TRACKING TOOL